Cheap Home Appraisal Near Me: Top 5 Best Tips in 2024

Finding an Affordable Home Appraisal Near You: Your Ultimate Guide

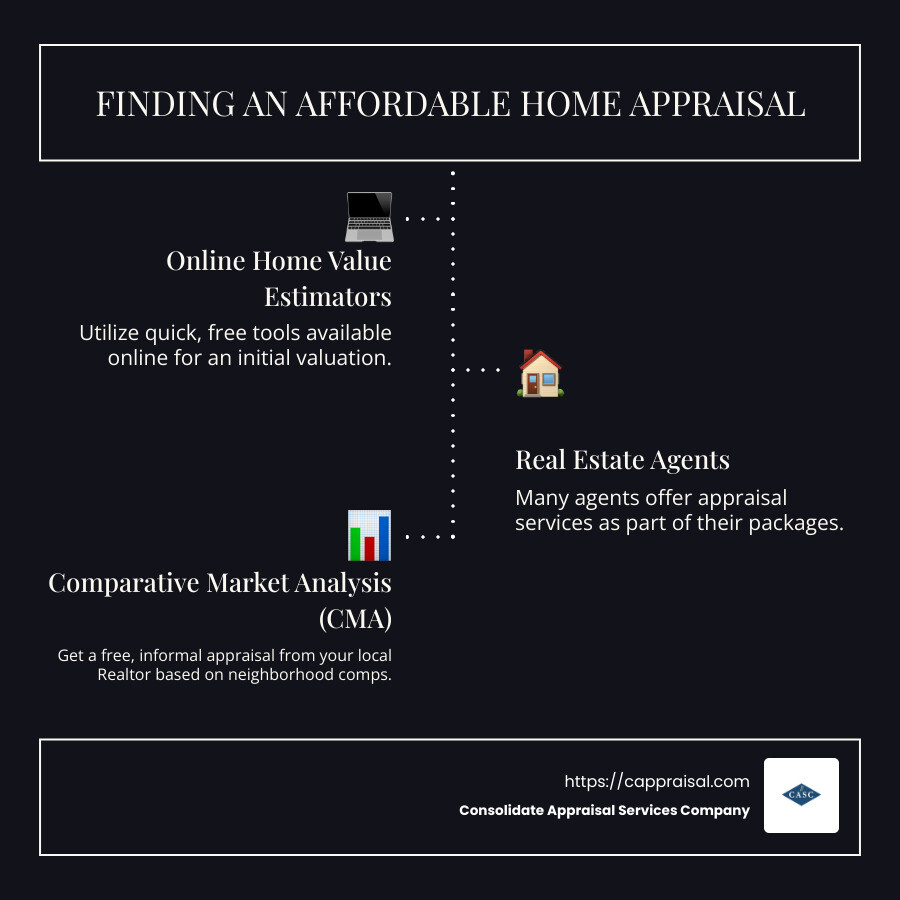

When searching for cheap home appraisal near me, there are several routes you can take to get a reliable yet affordable property evaluation:

- Online Home Value Estimators: Quick, free tools.

- Real Estate Agents: Many offer appraisal services as part of their packages.

- Comparative Market Analysis (CMA): A free, informal appraisal from your Realtor.

- Negotiating with Lenders: They might cover appraisal costs if you’re refinancing.

In today’s fluctuating real estate market, getting an accurate appraisal is crucial whether you’re refinancing, selling, or managing an inherited property. An unbiased home appraisal assesses your home’s market value and provides a solid foundation for making informed financial decisions.

My name is Timothy Harpster, and I’ve spent years helping property owners just like you steer the complexities of accurate valuations. As President of Consolidated Appraisal Services Company, my expertise in delivering dependable and affordable appraisals aligns perfectly with what you’re searching for.

Let’s explore more ways to secure that low-cost, accurate home appraisal.

What is a Home Appraisal?

A home appraisal is an unbiased evaluation of your property’s market value. Conducted by a third-party individual, an appraiser, this process is essential whether you’re selling, refinancing, or managing an inherited property.

Unbiased Evaluation

The key to a reliable appraisal is its unbiased nature. An appraiser has no vested interest in the property’s final value. They follow strict guidelines to ensure their assessment is fair and objective.

Market Value

The market value is the price a willing buyer would pay a willing seller in an open market. This value is crucial for setting a competitive sale price, securing a mortgage, or refinancing a loan.

Comparative Houses

Appraisers use comparative houses or “comps” to determine your home’s value. They look at recently sold properties in your area that are similar in size, condition, and features.

Curb Appeal

Curb appeal plays a significant role in appraisals. First impressions matter. A well-kept lawn, trimmed trees, and a clean driveway can positively influence the appraiser’s perception of your home’s value.

New Appliances and Cleanliness

New appliances and a clean home can also boost your appraisal. While cleanliness might not directly affect the value, it can make your home appear more spacious and well-maintained.

Updated HVAC System and Water Heater

An updated HVAC system and a new water heater are valuable assets. These improvements show that the home is up-to-date and well-cared-for, which can increase its market value.

New Roof

A new roof is another significant factor. Roof replacements are costly, and a new roof can make your home more attractive to buyers and appraisers alike.

By understanding what goes into a home appraisal, you can take steps to ensure your property is valued as accurately as possible. Getting an informed and fair appraisal can help you make better financial decisions, whether you’re looking to refinance, sell, or simply understand your home’s worth.

Ready to learn more about securing that low-cost, accurate home appraisal? Let’s explore detailed strategies and tips to make it happen.

Ways to Obtain a Free or Low-Cost Home Appraisal

Online Home Value Estimators

One of the easiest ways to get an initial valuation of your home is by using online home value estimators. These tools are often free and can give you a rough estimate based on publicly available data and recent sales in your area. While these estimates aren’t as accurate as a professional appraisal, they provide a good starting point.

Seek Appraisal Services During Promotions

Keep an eye out for discounts and promotions offered by appraisal companies. A quick Google search for “cheap home appraisal near me” can reveal local companies running promotions. Always call to confirm the final costs, as a little effort can save you $50 to $100 on your appraisal.

Inquire with Real Estate Agents

If you’re new to the home appraisal process, reach out to a trusted real estate agent. They often have connections with appraisers and might recommend someone who offers a free land appraisal as part of their service package. Agents sometimes have partnerships with appraisers, which can result in discounted rates for you.

Use Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) is an informal appraisal conducted by your local Realtor. They look at the local market to estimate your home’s value based on neighborhood comps. This service is usually free if you’re planning to sell your home. You can also run a basic CMA yourself by comparing your home’s square footage and amenities with similar properties in your area.

Negotiate with Lenders

If you need an appraisal to refinance your mortgage, try negotiating with your lender to cover the cost. Some lenders might be willing to pay for the appraisal, especially if the demand for home loans is low. Always talk to different mortgage lenders to find the best rates and perks, including a free home appraisal.

Taking these steps can help you get a low-cost or even free home appraisal, making the process of selling, buying, or refinancing your home more affordable. Ready to dive deeper into the appraisal process? Let’s explore tips for ensuring a successful appraisal next.

Tips for a Successful Appraisal Process

Getting a home appraisal is just the beginning. You want to make sure your home is valued as high as possible. Here are some simple but effective tips to help you achieve that:

Improve Your Curb Appeal

First impressions matter. The exterior of your home sets the tone for the entire appraisal. Spend some time on your curb appeal:

- Mow the lawn: A well-manicured lawn can make your home look more attractive.

- Trim trees and bushes: Overgrown greenery can obscure your home and make it look neglected.

- Pressure wash: Clean your driveway, sidewalks, and the exterior of your house to remove dirt and grime.

Clean the House

A clean home can appear more spacious and well-maintained. While the appraiser is trained to look past clutter, a tidy home can still make a positive impact.

- Declutter: Remove unnecessary items from rooms and storage areas.

- Deep clean: Make sure every room is spotless, including windows, floors, and appliances.

Make Repairs and Upgrades

Small repairs and upgrades can add significant value to your home. Focus on the following areas:

- New Appliances: Modern appliances can make your home more appealing and valuable.

- Basic Repairs: Fix leaky faucets, broken windows, and other minor issues.

- Floor Upgrades: Consider updating old carpeting or refinishing hardwood floors.

Communicate with the Appraiser

Don’t be shy about highlighting the best features of your home. Appraisers need the most up-to-date information to provide an accurate valuation.

- Highlight Upgrades: If you’ve recently installed a new water heater or HVAC system, make sure the appraiser knows.

- Provide Documentation: Have receipts and permits for any recent improvements readily available.

By following these tips, you can help ensure that your home is appraised at its highest possible value.

Potential Drawbacks and Considerations

While free or low-cost home appraisals can be appealing, there are some potential drawbacks and considerations you should keep in mind.

Online Tool Accuracy

Many online tools offer free estimates of your home’s value. However, these tools often rely on nearby home values and public records to generate their estimates. This means the data can be outdated or incomplete.

Additionally, these tools frequently use user-submitted data, which can be inaccurate or subjective. For example, if a user incorrectly inputs the square footage or other key details, the estimate will be off. Therefore, take these online estimates as a rough ballpark figure rather than a precise valuation.

Licensing Information and Online Reviews

If someone offers you a free home appraisal without your solicitation, be cautious. Always ensure that the person or company is licensed and has good reviews online. Ask for their licensing information and check websites for customer feedback.

This is crucial because scammers often pose as appraisers to gain access to your home or charge hidden fees after the appraisal. Reading online reviews can give you a sense of the appraiser’s reliability and professionalism.

Trusted Appraisers

For a clear and reliable home value report, it might be best to hire a trusted appraiser in your area. A local appraiser will be familiar with the unique characteristics of your neighborhood and can provide a more accurate valuation.

According to Master Appraisal Services, local expertise is crucial for accurate appraisals: “Valley home values are unique, and you need a local property appraiser with experience in your area to ensure the property value is accurate.”

When you need a precise and dependable home appraisal, investing in a trusted professional can save you from future headaches and financial surprises.

Frequently Asked Questions about Cheap Home Appraisal Near Me

What is the average appraisal fee in Wapakoneta, OH?

In Wapakoneta, OH, the typical cost for a home appraisal ranges from $450 to $600 for a standard single-family home. However, this price can vary based on the type of property and its specific needs. For instance, appraising a multi-family home or a property with unique features may cost more due to the additional time and expertise required.

How do you negotiate a low home appraisal?

If you receive a low home appraisal, there are several strategies you can employ:

Dispute the Appraisal: If you believe the appraisal is inaccurate, you can request a reconsideration of value (ROV) from your mortgage lender. Provide additional comps or evidence that supports a higher valuation.

Pay the Difference: If the seller is unwilling to lower the price, you might choose to pay the difference between the appraised value and the sale price.

Shift Money: Sometimes, you can negotiate with the seller to cover some closing costs, lowering your out-of-pocket expenses.

Negotiate a Lower Price: Use the low appraisal as leverage to negotiate a lower purchase price with the seller.

All-Cash Offer: If possible, make an all-cash offer. This removes the lender from the equation and can sometimes persuade the seller to accept a lower price.

Walk Away: If the appraisal is significantly lower than the agreed sale price and negotiations fail, you might decide to walk away from the deal.

Why is appraisal so expensive?

Home appraisals often seem costly because they involve a certified appraiser who must invest significant time and effort into the process. Here’s why:

Time: Appraisers spend hours inspecting the property, researching comparable sales, and analyzing market trends.

Research: They conduct thorough research to ensure an accurate and fair valuation. This includes examining public records, neighborhood data, and recent sales.

Comprehensive Report: The final appraisal report is detailed and comprehensive, providing a clear picture of the property’s market value. This report is crucial for lenders to assess the risk of the mortgage loan.

While the cost might seem high, remember that a professional appraisal can save you from overpaying for a property or help you secure a better mortgage deal.

Conclusion

At Consolidated Appraisal Services Company, we pride ourselves on delivering accurate property valuations for a variety of property types, including industrial, agricultural, residential, and commercial properties. Located in Wapakoneta, OH, our team ensures that each appraisal is conducted with the utmost professionalism and attention to detail.

We understand the importance of privacy and guarantee that all client information is handled confidentially. Whether you’re navigating the complexities of a real estate transaction, estate planning, or refinancing, our experienced appraisers are here to provide expert answers and support.

For more information on how we can assist you with your appraisal needs, visit our service page.