Home Appraisal Near Me: Top 7 Essential Tips for 2025

Understanding Home Appraisal Near Me

If you’re looking for a “home appraisal near me,” you’ve come to the right place! A home appraisal is a critical step in determining the true market value of your property. Whether you’re buying, selling, or refinancing, an accurate property valuation helps ensure a fair and smooth real estate transaction.

Quick Answer:

- A home appraisal offers an unbiased opinion of your property’s value based on several standardized approaches.

- It’s essential for securing a mortgage, setting a sale price, or appealing a property tax assessment.

- Common methods of appraisal include the Sales Comparison Approach, Cost Approach, and Income Approach.

Every homeowner and property investor needs a clear understanding of market value to make informed decisions. My name is Timothy Harpster, President of Consolidated Appraisal Services Company, with years of experience in providing accurate and reliable appraisals. Having appraised a range of properties from single-family homes to complex commercial estates, I strive to ensure every client receives the most precise evaluation possible to meet their real estate goals.

What is a Home Appraisal?

A home appraisal is a professional, unbiased opinion of a property’s market value. It’s conducted by a licensed or certified appraiser who follows standardized methods to ensure accuracy and fairness.

Why is an Unbiased Opinion Important?

When buying or selling a home, emotions can cloud your judgment. A professional appraiser provides an unbiased opinion based on data and standardized methods, ensuring you get a fair market value.

“Lyle Gallagher is one of the most qualified appraisers that this organization has had the privilege to work with.”

— Jeffrey C. Smith, President, American Eagle Mortgage

Determining Market Value

The appraiser considers several factors to determine the market value of a property:

- Location: Proximity to amenities like schools and parks

- Condition: The state of the property, including any needed repairs

- Size and Layout: Total square footage and room configuration

- Comparable Sales: Recent sales of similar properties in the area

The Role of a Professional Appraiser

A professional appraiser is trained to evaluate properties using various methods such as the Sales Comparison Approach, Cost Approach, and Income Approach. They inspect the property, gather data, and compile a detailed report outlining their findings.

Mortgage Requirement

For most mortgage loans, an appraisal is a lender requirement to confirm the property’s value supports the loan amount. This protects both the lender and the borrower from overvalued property risks.

Understanding the true value of your property is crucial for making informed decisions in real estate transactions. An unbiased, professional appraisal ensures you don’t overpay or undersell, and it can be essential for securing a mortgage.

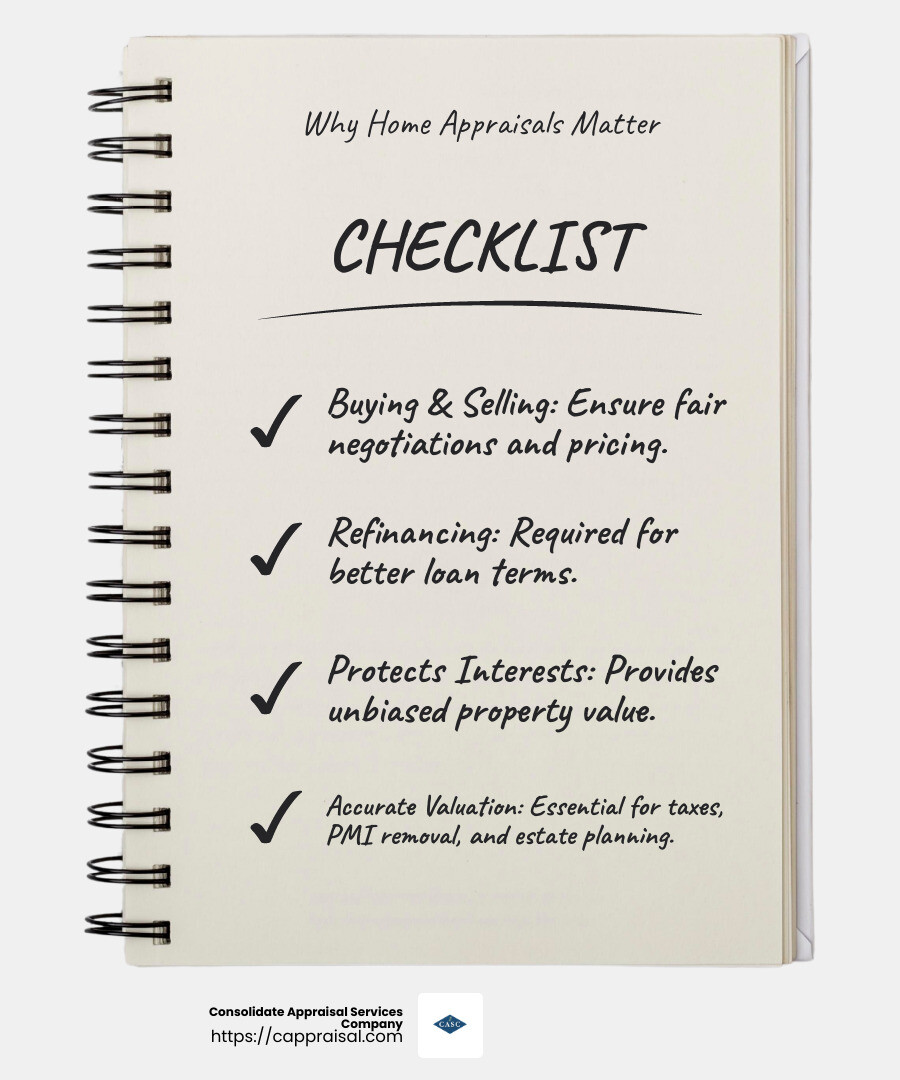

Why You Need a Home Appraisal

Buying and Selling

When you’re buying or selling a home, knowing its true market value is essential. An accurate appraisal ensures that you don’t overpay for a property or undersell your own. For buyers, this means you can negotiate a fair price based on solid data. For sellers, an appraisal helps set a competitive price that attracts buyers without leaving money on the table.

“A home appraisal can be a powerful negotiating tool when buying or selling a property.”

— Rand Fishkin, Real Estate Expert

Refinancing

If you’re considering refinancing your mortgage, an appraisal is often a necessity. Lenders need to know the current value of your property to determine how much they can lend you. An up-to-date appraisal can help you qualify for better loan terms, potentially saving you thousands of dollars in interest over the life of the loan.

Protecting Interests

An appraisal protects the interests of all parties involved in a real estate transaction. It provides an unbiased, professional assessment of the property’s value, which can prevent disputes and ensure a smoother transaction process.

Accurate Valuation

An accurate valuation is critical for various reasons:

- Tax Purposes: Knowing your property’s value can help you understand your tax liabilities and avoid overpaying on property taxes.

- PMI Removal: If you have Private Mortgage Insurance (PMI), an appraisal can help you remove it once your loan-to-value ratio meets the required threshold.

- Estate Planning: An appraisal is essential for equitable asset division in situations like inheritance or divorce.

By obtaining a professional appraisal, you get a clear, unbiased picture of your property’s worth, helping you make informed decisions and protecting your financial interests.

Next, we’ll dive into the factors that affect home appraisal costs.

Factors Affecting Home Appraisal Costs

When you’re looking for a home appraisal near me, understanding the factors that influence the cost is crucial. Here’s a breakdown of what affects the price of a home appraisal:

Location

The location of your property is one of the most significant factors. Homes in urban areas often have higher appraisal costs due to the complexity of the market. Conversely, rural properties might cost more due to the travel time and effort required for the appraiser to reach the location.

Travel Distance

Speaking of travel, the distance an appraiser needs to travel can also impact the cost. If your property is located far from the appraiser’s office, expect to pay a bit more to cover the travel expenses. This is especially true for rural or remote areas.

Demand

The demand for appraisals in your area can also affect the cost. During peak real estate seasons, when buying and selling activity is high, appraisers are in greater demand. This can lead to higher prices due to the increased workload and limited availability of certified appraisers.

Property Size

The size of your property plays a role in the appraisal cost. Larger homes require more time to inspect and evaluate, which can increase the fee. This includes not just the square footage of the house but also the size of the land it sits on.

Appraisal Type

Different types of appraisals come with different price tags. Here are a few common types:

- Full Appraisal: This is the most comprehensive and involves a detailed inspection of the property. It’s typically the most expensive option.

- Drive-By Appraisal: This type involves a less detailed inspection, often just an exterior assessment. It’s less costly but also less thorough.

- Desktop Appraisal: Conducted without a physical inspection, this type uses data and records to determine the property’s value. It’s usually the least expensive but might not be as accurate.

Understanding these factors can help you budget for your home appraisal and choose the right type of service for your needs.

Next, we’ll explore the different types of home appraisals available.

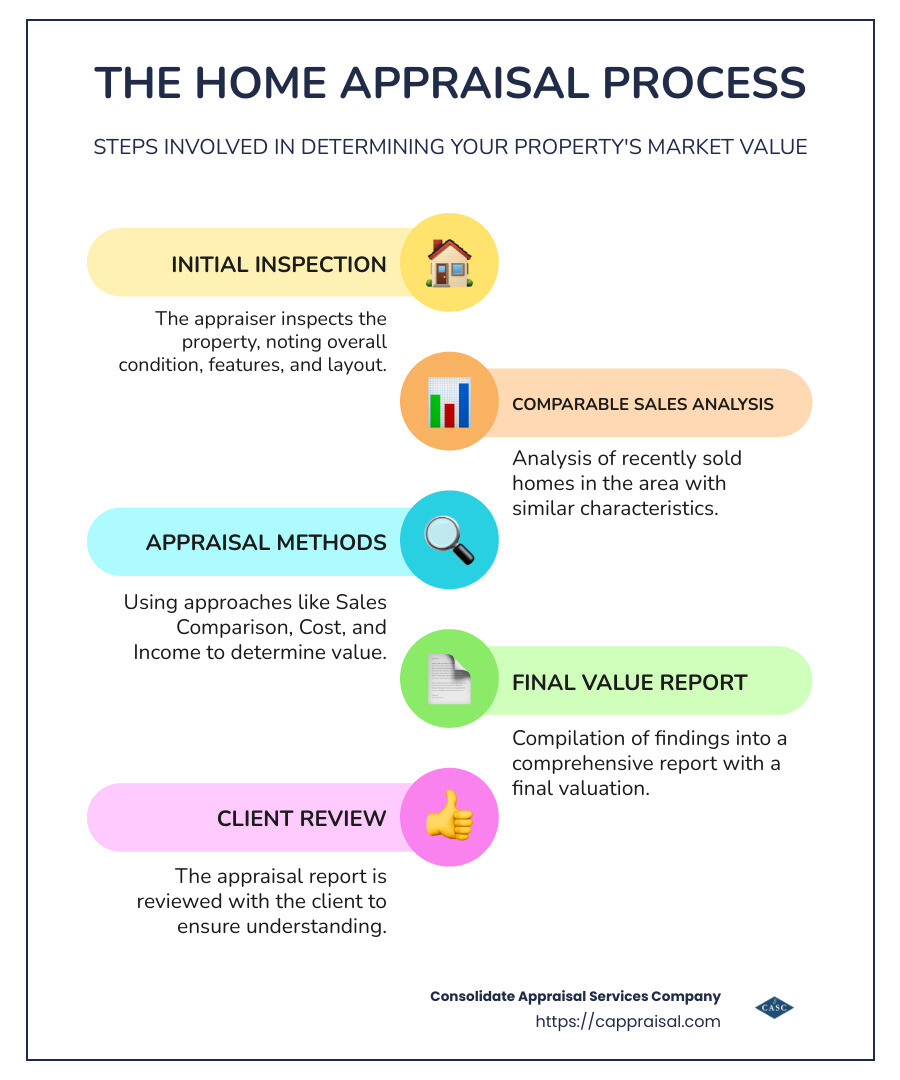

The Home Appraisal Process

Understanding the home appraisal process can help you steer it smoothly and ensure you get an accurate property valuation. Here’s a breakdown of the key steps involved:

Inspection

The first step is the inspection. The appraiser visits your property to evaluate its condition, layout, and features. This includes both the interior and exterior. They’ll measure the square footage, check the number of rooms, and note any upgrades or improvements.

Tip: Make sure all areas of your home are accessible and tidy. Minor repairs and a clean presentation can make a good impression.

Comparable Sales

Next, the appraiser looks at comparable sales (or “comps”). These are recent sales of similar properties in your area. By comparing your home to others that have sold nearby, the appraiser can gauge its market value.

They’ll consider factors like:

- Location

- Size

- Condition

- Age

- Features

Using comps helps ensure the appraisal reflects current market conditions.

Final Report

After the inspection and analysis of comparable sales, the appraiser compiles a final report. This document includes:

- A street map showing the location of your property and the comps

- An exterior building sketch

- Photographs of your home and the comps

- An explanation of how the square footage was calculated

- Market sales data, public land records, and tax records

The final report is a comprehensive evaluation of your property’s value. It’s used by buyers, sellers, and lenders to make informed decisions.

Appraisal Methods

Appraisers use different appraisal methods to determine property value. The most common methods are:

- Sales Comparison Approach: This involves comparing your property to similar recently sold properties.

- Cost Approach: This estimates the cost to replace your property with a similar one, considering current construction costs.

- Income Approach: Primarily used for rental properties, this calculates value based on the income potential of the property.

Each method provides a different perspective, and the appraiser may use a combination of these to arrive at the final value.

Understanding the home appraisal process can explain what might seem like a complex step in buying or selling a home. Next, we’ll explore the different types of home appraisals available.

Types of Home Appraisals

When it comes to home appraisal near me, there are several types of appraisals you might encounter. Each type serves a different purpose and suits different needs. Here’s a quick rundown:

Full Appraisal

A full appraisal is the most thorough type. The appraiser visits your property to conduct a detailed inspection. They look at the interior and exterior, measure square footage, and note the number of rooms and any upgrades.

This type of appraisal uses the Sales Comparison Approach, Cost Approach, and sometimes the Income Approach to determine the property’s value. It includes a comprehensive final report with photographs, sketches, and market data.

Pros:

- Most accurate

- Detailed report

- Suitable for all property types

Cons:

- More expensive

- Time-consuming

Drive-By Appraisal

A drive-by appraisal is less detailed. The appraiser only looks at the exterior of the property and evaluates its condition from the street. They’ll still use comparable sales data to estimate the value.

This type is quicker and cheaper but might not be as accurate as a full appraisal.

Pros:

- Faster

- Less expensive

Cons:

- Less detailed

- May miss important interior features

Desktop Appraisal

A desktop appraisal is done remotely. The appraiser doesn’t visit the property. Instead, they rely on public records, MLS data, and other online information to estimate the value.

This is the quickest and cheapest option but also the least accurate.

Pros:

- Fastest

- Least expensive

Cons:

- Least detailed

- Relies on available data

Cost Approach

The Cost Approach is a method used to estimate the value based on the cost to replace the property with a similar one. It’s often used for unique properties that don’t have many comparable sales, like schools or churches.

Here’s how it works:

- Estimate the land value.

- Calculate the replacement cost of the building.

- Subtract depreciation.

Pros:

- Useful for unique properties

- Considers current construction costs

Cons:

- May not reflect market conditions

- More complex to calculate

Understanding these different types of home appraisals can help you choose the right one for your needs. Whether you need a detailed full appraisal or a quick desktop appraisal, knowing your options ensures you get the most accurate valuation possible.

Next, let’s dive into how to find the best home appraisal companies near you.

Finding the best home appraisal near me can be straightforward if you know what to look for. Here’s a quick guide to help you make an informed choice.

Certified Appraisers

First and foremost, ensure the appraiser is certified. Certified appraisers have undergone rigorous training and exams to ensure they can provide accurate and unbiased valuations. Look for credentials like “Certified Residential Appraiser” or “Certified General Appraiser.” These certifications indicate that the appraiser meets state and national standards.

Local Expertise

Local expertise is crucial. An appraiser who knows your area well can provide a more accurate valuation. They understand the local market trends, neighborhood nuances, and comparable sales. For example, a highly qualified appraiser with extensive local knowledge can be a valuable asset for accurate property valuations.

Customer Reviews

Customer reviews can offer insights into the quality of service you can expect. Look for reviews on Google, Yelp, or specialized real estate websites. Pay attention to comments about the appraiser’s professionalism, accuracy, and turnaround time. Positive reviews can give you confidence in your choice, while negative ones can serve as red flags.

Service Offerings

Different appraisal companies offer various services. Ensure the company you choose can meet your specific needs, whether it’s a full appraisal, drive-by appraisal, or desktop appraisal. Some companies also offer specialized services like estate planning, tax assessment appeals, and investment analysis. For instance, Consolidate Appraisal Services Company provides a wide range of services, from single-family homes to complex commercial properties.

By focusing on certified appraisers with local expertise, checking customer reviews, and understanding the service offerings, you can find the best home appraisal near me to meet your needs.

Frequently Asked Questions about Home Appraisals

Are Home Appraisals Worth It?

Absolutely. Home appraisals are crucial for several reasons:

- Accurate Valuation: An accurate appraisal ensures you’re not overpaying or underselling your property. This is essential whether you’re buying, selling, or refinancing. According to Investopedia, appraisals help in making informed decisions by providing a fair market value.

- Loan Approval: Lenders require an appraisal to approve your mortgage. The appraisal assures the lender that the property is worth the loan amount.

- PMI Removal: If you believe your home has appreciated enough to remove Private Mortgage Insurance (PMI), an appraisal can confirm this. As noted in the Clearfork Appraisals research, many appraisers offer specific services for PMI removal, which can save you money in the long run.

- Tax Challenges: If you think your property tax assessment is too high, an appraisal can provide evidence to challenge it. Cappraisal.com mentions that a limited appraisal or neighborhood analysis can be cost-effective for this purpose.

Why is Home Appraisal So Expensive?

Home appraisals can seem pricey, but several factors justify the cost:

- Expertise and Certification: Certified appraisers have undergone extensive training and exams. This ensures they provide accurate and unbiased valuations. Their expertise comes at a premium.

- Comprehensive Analysis: Appraisers conduct a thorough inspection, analyze comparable sales, and compile a detailed report. This process is time-consuming and requires a high level of skill.

- Location and Property Size: The cost can vary based on the location and size of the property. Properties in remote areas require more travel time, and larger properties take longer to inspect and evaluate.

- Demand: In high-demand markets, appraisers may charge more due to increased workload. According to Investopedia, the cost typically ranges between $300 and $450, but can vary based on these factors.

What is the Cost Approach to a Home Appraisal?

The cost approach is one of the three main methods appraisers use to determine a property’s value. Here’s a breakdown:

- Replacement Cost: This method estimates the cost to replace the property with a similar one. It considers the current cost of constructing a similar structure, minus depreciation.

- Land Value: The appraiser adds the estimated land value to the replacement cost. This value is based on comparable land sales in the area.

- Depreciation: The appraiser subtracts depreciation from the replacement cost. Depreciation accounts for wear and tear, age, and any functional or external obsolescence.

The cost approach is particularly useful for new constructions and unique properties where comparable sales are limited. It provides an objective estimate based on tangible costs rather than market trends.

By understanding these aspects, you can better appreciate the value and necessity of a home appraisal. This knowledge will help you make informed decisions in your real estate transactions.

Conclusion

Choosing Cappraisal for your home appraisal needs ensures you get accurate property valuations backed by expertise and a commitment to privacy. Our team at Consolidated Appraisal Services Company in Wapakoneta, OH, prides itself on providing reliable and precise appraisals for a variety of properties, including residential, commercial, industrial, and agricultural.

Our certified appraisers use a methodical approach to deliver valuations that stand up to scrutiny. Whether you’re buying, selling, refinancing, or handling a legal matter, we provide the expert answers you need to make informed decisions. We understand the importance of privacy and guarantee that all your information will be handled with the utmost confidentiality.

For more information on how we can assist with your appraisal needs, visit our service page and take the first step toward securing an accurate valuation for your property.

By choosing us, you’re ensuring that your property’s value is assessed with the highest level of accuracy and integrity. Let us help you steer the complexities of real estate with confidence and peace of mind.