Market Rental Appraisal: Top 5 Proven Methods

What is Market Rental Appraisal and Why It Matters

Market rental appraisal is a crucial step for anyone involved in property investments, whether you’re new to the game or a seasoned expert. This appraisal helps determine what rent your property might reasonably generate based on current market conditions and comparable rental properties in your area.

Here are the quick basics you need to know:

- Definition: Market rental appraisal evaluates potential rental income based on current market trends and comparable properties.

- Purpose: Essential for securing loans, setting appropriate rent prices, and understanding investment returns.

Hello! My name is Timothy Harpster, President of Consolidated Appraisal Services Company. With years of experience and specialized appraisal education, I aim to simplify complex concepts like market rental appraisal for property owners and investors.

What is Market Rental Appraisal?

Market rental appraisal evaluates a property’s potential rental income based on current market trends and comparable rental properties in the area.

Definition

A market rental appraisal is a professional assessment conducted to determine the fair rental value of a property. It considers various factors like the condition of the property, amenities, and local market conditions.

Purpose

The primary purpose of a market rental appraisal is to help property owners set a competitive rent price. This ensures the property is attractive to potential tenants while maximizing income.

Market Value vs. Rental Value

It’s crucial to distinguish between market value and rental value.

- Market Value: The price at which a property would sell in the current market.

- Rental Value: The amount of rent a property can command based on similar properties in the area.

Why It Matters

Understanding these values helps property owners make informed decisions. For instance, knowing the rental value is essential when applying for a loan, as lenders often require this information. It also assists in evaluating the potential return on investment when purchasing new properties.

A rental appraisal includes:

- Market Trends: Current conditions affecting rental prices.

- Comparable Properties: Analysis of similar properties in the area.

- Demographic Insights: Understanding the target market for the rental property.

By providing a clear picture of potential rental income, a market rental appraisal helps property owners set realistic expectations and make strategic decisions.

This leads us to the next section, where we dig into the various methods used for market rental appraisals.

Methods for Market Rental Appraisal

When it comes to market rental appraisal, several methods can help you determine a property’s rental value. Each method has its strengths and is suited to different types of properties and market conditions. Let’s explore the most common approaches used by real estate investors.

Sales Comparison Approach

The sales comparison approach is a popular method for appraising single-family rental properties. It involves comparing the subject property to recently sold, similar properties in the same area.

Steps to Follow:

- Identify Comparable Sales: Find 3-5 recently sold properties similar in size, condition, and features.

- Adjust Comparable Prices: Make adjustments for differences. For example, if a comparable property has an extra bedroom, subtract value from its sale price.

- Calculate Adjusted Sales Price: Determine the adjusted sales price for each comparable.

- Estimate Property Value: Average the adjusted sales prices to estimate the market value of the subject property.

Example:

- Property: 1500 sq. ft, three beds, two baths.

- Comparable A: Sold for $260,000; -10% adjustment for fewer bedrooms/bathrooms.

- Comparable B: Sold for $275,000; +5% adjustment for smaller size.

- Comparable C: Sold for $250,000; identical, no adjustment.

The estimated value of the property is approximately $265,000.

Income Approach

The income approach is ideal for investment properties like apartments or commercial buildings. It focuses on the property’s potential income.

Key Components:

- Gross Rental Income: Total annual income from rent and other sources like parking fees.

- Operating Expenses: Annual costs for property maintenance, management fees, taxes, insurance, and utilities.

- Net Operating Income (NOI): Gross rental income minus operating expenses.

- Capitalization Rate (Cap Rate): A rate reflecting the expected return on investment, varying by market and property type.

- Property Valuation: Calculated by dividing the NOI by the cap rate.

Example:

- Gross Rental Income: $50,000/year

- Operating Expenses: $15,000/year

- Net Operating Income: $35,000/year

- Cap Rate: 6%

The estimated value of the property is approximately $583,333.

Gross Rent Multiplier Approach

The gross rent multiplier (GRM) approach is a quick method focusing on the ratio of the property’s price to its annual rental income.

Key Components:

- Gross Rental Income: Total annual income from the property.

- Sale Price of Comparable Properties: Selling prices of similar properties.

- Gross Rent Multiplier: Sale price divided by annual gross rental income.

- Property Valuation: GRM multiplied by the property’s annual gross rental income.

Example:

- Sold Property GRM: $300,000 sale price / $30,000 annual income = GRM of 10.

- Comparable Property: Annual income of $40,000.

Using the GRM approach, the value of the property is $40,000 * 10 = $400,000.

Cost Approach

The cost approach estimates the value of a property based on the cost to replace it. This method is useful for unique or new properties.

Key Components:

- Land Value: Value of the land if vacant.

- Construction Cost: Current cost to build a similar structure.

- Depreciation: Reduction in value due to wear and tear or outdated features.

- Depreciated Building Cost: Construction cost minus depreciation.

- Total Property Value: Depreciated building cost plus land value.

Example:

- Land Value: $60,000

- Construction Cost: $180,000

- Depreciation: $30,000

- Depreciated Building Cost: $150,000

The property value using the cost approach is $210,000.

Capital Asset Pricing Model

The capital asset pricing model (CAPM) helps investors calculate the expected return on a property, considering the risk compared to the market.

Key Components:

- Risk-Free Rate: Return on a risk-free investment, like government bonds.

- Market Return: Average return of the market.

- Property Risk: The specific risk associated with the property.

CAPM is more complex and involves financial modeling to estimate the expected return, helping investors decide if the property meets their risk and return criteria.

In the next section, we will outline the steps to conduct a market rental appraisal, ensuring you have a clear roadmap for evaluating properties.

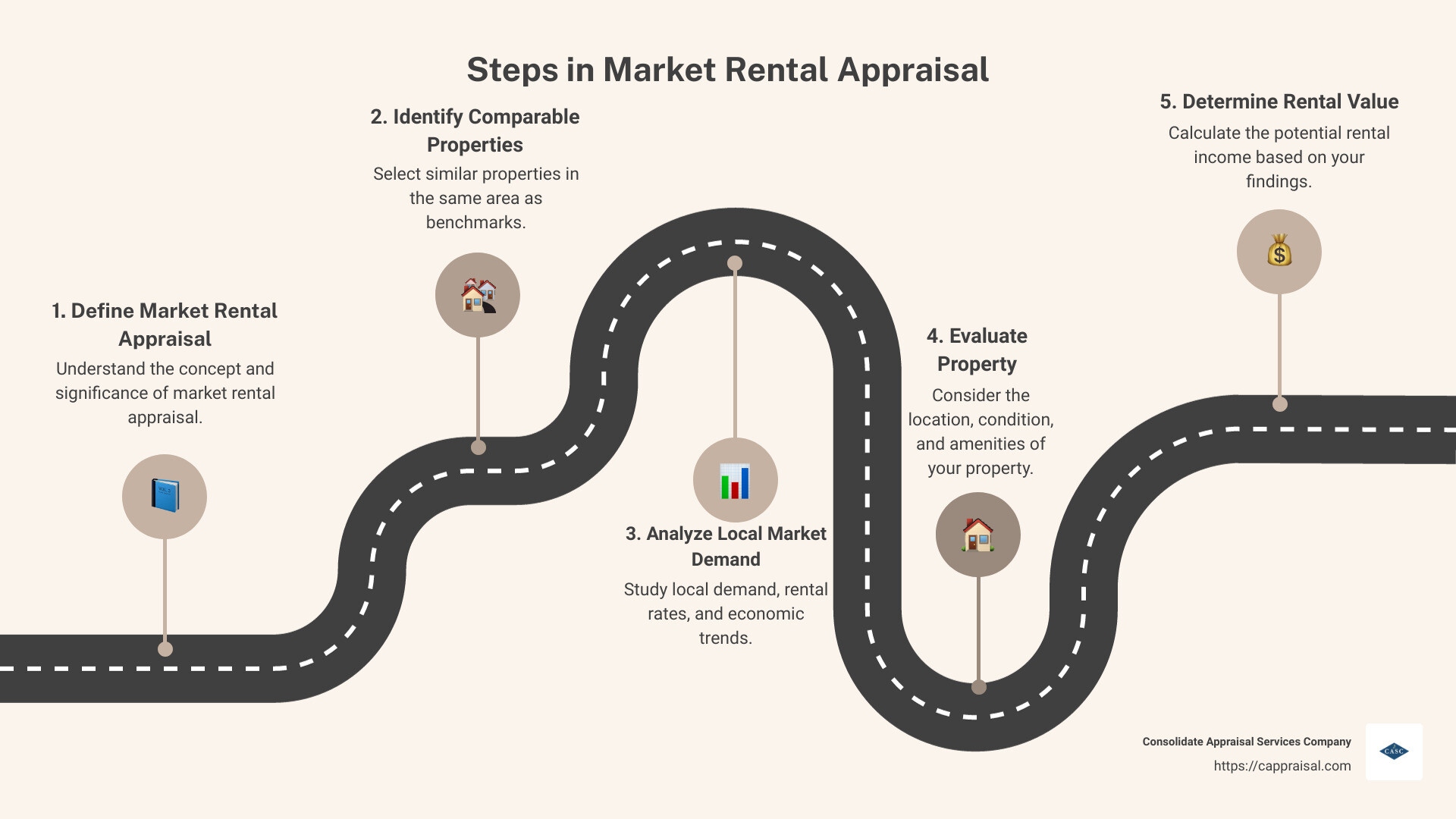

Steps to Conduct a Market Rental Appraisal

Identifying Comparable Properties

The first step in a market rental appraisal is identifying comparable properties. These are properties similar to the one you’re appraising, located in the same area, and with similar features.

Steps to Identify Comparables:

- Search Recent Sales: Look for properties that have sold recently in the same neighborhood.

- Match Key Features: Ensure they have similar size, layout, number of bedrooms and bathrooms, and amenities.

- Adjust for Differences: Make any necessary adjustments for differences in features, like an extra bedroom or a newer kitchen.

Example:

- Subject Property: 1500 sq. ft, three beds, two baths.

- Comparable A: Sold for $260,000; -10% adjustment for fewer bedrooms/bathrooms.

- Comparable B: Sold for $275,000; +5% adjustment for smaller size.

- Comparable C: Sold for $250,000; no adjustment.

Using these comparables, you can estimate the market value of the subject property to be around $265,000.

Analyzing Local Market Demand and Rental Rates

Understanding the local market demand and rental rates is crucial. This involves examining economic trends and rental data to gauge how much rent you can charge.

Key Factors to Analyze:

- Market Demand: Look at vacancy rates and the number of rental applications in the area.

- Rental Rates: Compare the rental prices of similar properties.

- Economic Trends: Consider factors like employment rates, local business growth, and overall economic health.

Example:

If the local vacancy rate is low and similar properties are renting for $1,500 per month, your property is likely to command a similar rate.

Evaluating Property Location, Condition, and Amenities

The location, condition, and amenities of a property significantly influence its rental value.

Key Elements to Evaluate:

- Location: Proximity to schools, parks, shopping centers, and public transportation.

- Condition: The physical state of the property, including the roof, foundation, plumbing, and electrical systems.

- Amenities: Features like parking, laundry facilities, and outdoor spaces.

Example:

A property near a top-rated school and with modern amenities like a new kitchen and updated bathrooms will generally have a higher rental value.

Understanding Economic and Demographic Trends

Economic and demographic trends provide context for the rental market. These trends help predict future rental demand and potential rental income.

Factors to Consider:

- Economic Trends: Look at local job growth, income levels, and economic stability.

- Demographic Trends: Analyze population growth, age distribution, and household sizes.

Example:

In a growing city with increasing job opportunities and a young population, rental demand is likely to be strong, supporting higher rental rates.

By following these steps, you can conduct a thorough market rental appraisal and make informed decisions about your rental property investments.

Next, we’ll dig into the key factors influencing market rental value, ensuring you understand what drives rental prices and how to maximize your property’s potential.

Factors Influencing Market Rental Value

Property Condition and Upkeep

Maintaining your rental property in good condition is crucial. Regular maintenance, timely repairs, and updates can significantly boost its rental value.

Key Areas to Focus On:

- Regular Maintenance: Ensure that all systems (plumbing, electrical, HVAC) are functioning properly.

- Timely Repairs: Fix issues like leaks, broken windows, or faulty appliances promptly.

- Updates and Upgrades: Modernize kitchens, bathrooms, and living spaces to make the property more appealing.

Example:

A well-maintained property with updated appliances and fresh paint can command higher rent compared to a neglected one. Tenants are willing to pay more for a property that feels new and well-cared-for.

Location and Neighborhood

The location of your property plays a significant role in determining its rental value. Properties in desirable neighborhoods with good amenities can attract higher rents.

Factors to Consider:

- Proximity to Amenities: Schools, parks, shopping centers, and public transportation.

- Neighborhood Desirability: Safety, cleanliness, and overall appeal of the area.

- Street Conditions: Well-maintained streets and sidewalks add to the attractiveness of the location.

Example:

A rental property located near a top-rated school and within walking distance of shops and restaurants will likely have a higher rental value than one in a less desirable area.

Rental Market Trends

Understanding current rental market trends is essential for setting the right rental rate.

Key Trends to Monitor:

- Vacancy Rates: Lower vacancy rates indicate higher demand, allowing you to charge more.

- Rental Rates: Compare with similar properties to ensure your rates are competitive.

- Market Demand: High demand areas can support higher rental prices.

Example:

If the local rental market shows a trend of increasing rents due to high demand and low vacancy rates, you can confidently set a higher rental rate for your property.

Seasonal and Economic Factors

Seasonality and broader economic conditions also affect rental values.

Considerations:

- Seasonality: Rental demand often fluctuates with the seasons. For example, more people move in the summer, increasing demand and rental prices.

- Economic Conditions: Local job growth, income levels, and economic stability can impact rental rates.

Example:

During an economic boom, with rising employment and income levels, rental demand typically increases, allowing property owners to charge higher rents.

By keeping your property in excellent condition, understanding the importance of location, staying updated on rental market trends, and considering seasonal and economic factors, you can maximize the rental value of your property.

Next, we’ll explore how to conduct a site inspection to ensure you have all the accurate information needed for a successful market rental appraisal.

How to Maximize Your Market Rental Appraisal

Conduct a Site Inspection

A site inspection is a crucial step to ensure an accurate market rental appraisal. During a site inspection, an appraiser visits the property to gather information. This helps them provide a well-supported rental value.

Why It Matters:

- Accurate Information: Online data can be outdated or inaccurate. A site inspection ensures the appraiser sees the actual condition of the property.

- Up-to-Date Details: If your property has recent updates or is well-maintained, the appraiser can note these improvements, potentially increasing the rental value.

Example:

Imagine you have a rental property with a newly renovated kitchen and bathroom. If the appraiser only relies on old pictures or descriptions, they might not account for these upgrades. A site inspection ensures all recent improvements are considered, which can maximize your rental value.

Cost Consideration: While a site inspection might cost around $75 more, it ensures no vital detail is overlooked, making it a worthwhile investment.

Avoid Providing a Range of Value

When appraisers provide a range of value, lenders often use the lower end of the range, which can negatively impact financing.

Key Points:

- Exact Value: Ensure your appraiser gives an exact rental value instead of a range. This helps in securing better financing terms.

- Lender Considerations: Lenders prefer a specific rental value to assess the property’s potential income accurately.

Example:

If an appraiser provides a rental range of $1,300 to $1,700 per month, a lender might base their decision on the lower end ($1,300). However, if the appraiser specifies the rental value as $1,500 per month, it reflects the true market value and can improve financing options.

Include Special Instructions

When ordering an appraisal, including special instructions can guide the appraiser to consider specific factors that might influence the rental value.

Tips:

- Requested Rent: Mention your desired rent in the special instructions. If you have a lease agreement indicating $1,500 per month, state it clearly.

- Rental Agreements: Provide any existing lease agreements to support your requested rental value.

Example:

If you want the appraiser to consider a rental value of $1,500 per month, include this in the special instructions. This makes the appraiser more likely to align their valuation with your expectations, as opposed to providing a lower figure based on conservative estimates.

Pro Tip: Once a value is uploaded to platforms like Solidifi or NAS, it’s challenging to make changes. Ensure all crucial information is provided upfront.

By conducting a site inspection, avoiding ranges of value, and including special instructions, you can maximize your market rental appraisal and secure the best possible financing terms for your property.

Next, we’ll address some frequently asked questions about market rental appraisals to help you better understand the process and its importance.

Frequently Asked Questions about Market Rental Appraisal

How to Calculate Market Value of Rental Property?

Calculating the market value of a rental property can be straightforward if you use the right method. One common way is the Gross Rent Multiplier (GRM) approach.

Gross Rent Multiplier (GRM):

- Find Comparable Properties: Look for similar properties in the area that have been recently sold and rented.

- Calculate GRM: Divide the property price by its annual rental income.

- Estimate Your Property’s Value: Multiply your property’s annual rental income by the GRM.

For example, if comparable properties have a GRM of 10 and your property generates $30,000 in annual rental income, the estimated market value would be:

[ \text{Market Value} = \text{GRM} \times \text{Annual Rental Income} ]

[ \text{Market Value} = 10 \times 30,000 = \$300,000 ]

What is the Market Determined Rental Rate?

The market determined rental rate is the fair rental price for a property based on current market conditions. It can be figured out through demand research and comparable property analysis.

Steps to Determine Market Rental Rate:

- Analyze Comparable Properties: Look at similar properties in the same area. Check their rental rates.

- Research Market Demand: Understand the local rental market demand. High demand can increase rental rates.

- Consider Economic Trends: Economic conditions, such as employment rates and local economic growth, can impact rental rates.

For instance, if similar properties in your area rent for $1,200 to $1,500 per month, and the demand for rentals is high, you can set a competitive rental rate within this range.

What is Market Rental Value?

Market rental value is the amount a tenant would reasonably pay to lease a property in the current market. This value is crucial for both landlords and investors.

Factors Influencing Market Rental Value:

- Fair Market Value: The price a property would sell for in a competitive market.

- Lease Terms: The length and conditions of the lease agreement.

- Property Condition: Well-maintained properties generally command higher rents.

- Location and Amenities: Properties in desirable neighborhoods with good amenities often have higher rental values.

For example, a rental property in a prime location with modern amenities and in excellent condition will likely have a higher market rental value compared to a similar property in a less desirable area.

Fair Market Value Example:

If a property has a fair market value of $300,000 and the typical rental yield in the area is 6%, the annual rental income would be:

[ \text{Annual Rental Income} = \text{Fair Market Value} \times \text{Rental Yield} ]

[ \text{Annual Rental Income} = 300,000 \times 0.06 = \$18,000 ]

[ \text{Monthly Rental Income} = \frac{18,000}{12} = \$1,500 ]

Understanding these key concepts can help you better steer the market rental appraisal process and make informed decisions about your rental property investments.

Conclusion

In summary, market rental appraisal is a comprehensive process that determines the fair rental value of a property based on various factors. These factors include the property’s condition, location, comparable rental rates, and broader market trends. By accurately appraising rental properties, landlords and investors can set competitive rental rates, ensure sustainable income, and make informed investment decisions.

Accurate appraisals are crucial for several reasons. They help property owners avoid overpricing or underpricing their rentals, which can lead to prolonged vacancies or lost income. Appraisals also provide valuable insights for potential buyers and lenders, ensuring that financial decisions are based on realistic property values.

At Consolidated Appraisal Services Company, we specialize in providing precise and reliable real estate appraisals. Our experienced team is dedicated to helping property owners and investors understand the true value of their properties, ensuring they make informed decisions. Whether you need an appraisal for a residential, commercial, agricultural, or industrial property, we are here to assist you every step of the way.

For more information or to schedule an appraisal, contact us today. Accurate appraisals are the foundation of successful real estate investments, and we are committed to delivering the expertise and insights you need.