Miami County Auditor: Top 5 Expert Property Appraisal Tips

Understanding the Role of the Miami County Auditor

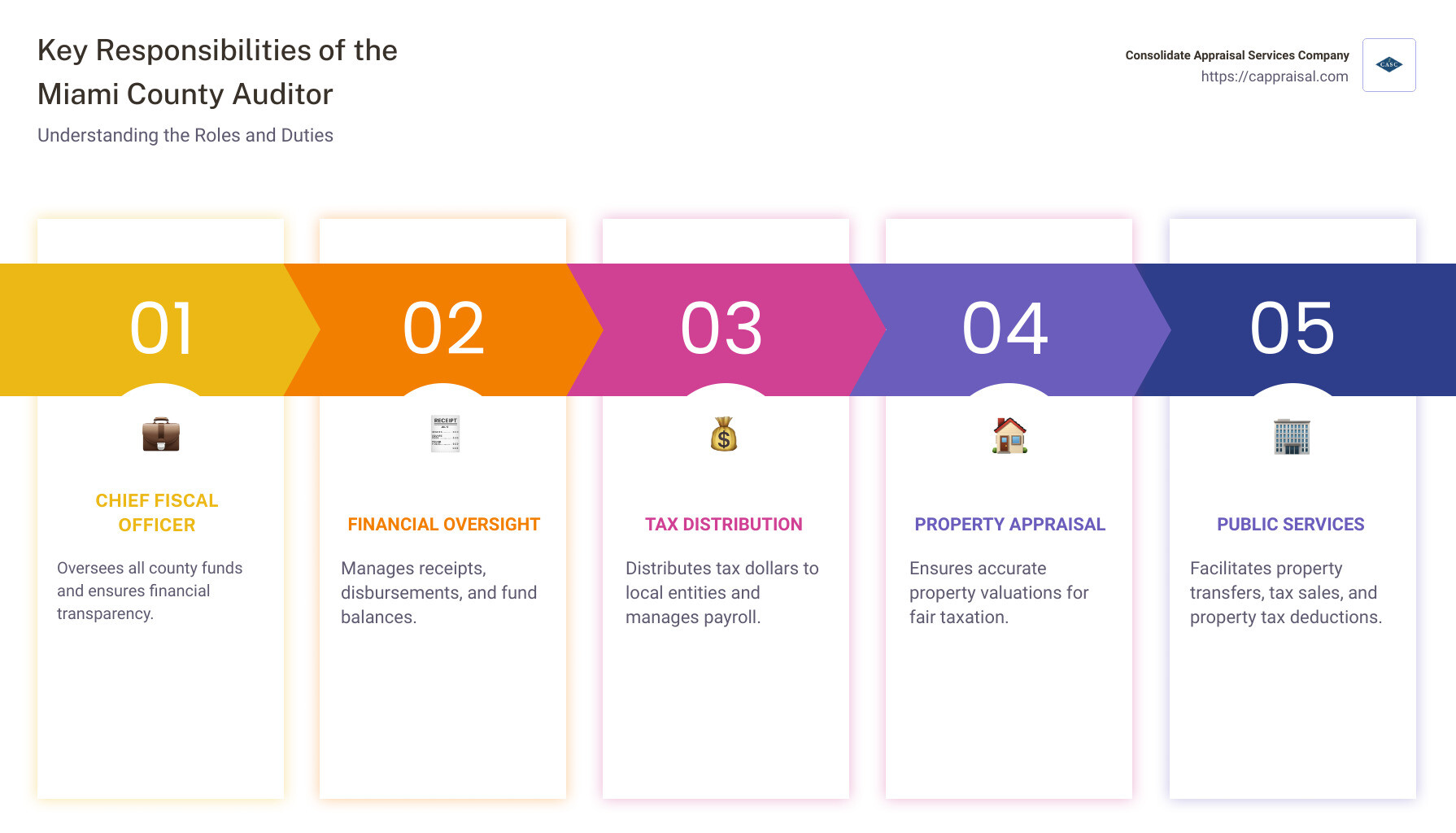

If you need insights on the chief fiscal officer of Miami County, you’re in the right place. The miami county auditor is responsible for:

- Serving as the County’s chief fiscal officer and watchdog over all county funds.

- Managing receipts, disbursements, and fund balances.

- Issuing warrants (checks) for County obligations.

- Overseeing the distribution of tax dollars to various local entities.

- Acting as the paymaster for all County employees.

Simply put, the miami county auditor plays a vital role in the financial stability and accurate property valuation of Miami County, Ohio. This ensures that everything from tax distribution to employee payroll runs smoothly.

I’m Timothy Harpster, President of Consolidated Appraisal Services Company. I hold the Accredited Rural Appraiser (ARA) designation and bring experience in property valuations, including in Miami County.

Now, let’s dive into what makes the Miami County Auditor essential to homeowners, businesses, and government entities alike.

Role of the Miami County Auditor

The Miami County Auditor holds a crucial position as the county’s chief fiscal officer. This role involves many key responsibilities that ensure the financial health and transparency of the county. Let’s break down what the auditor does:

Financial Responsibilities

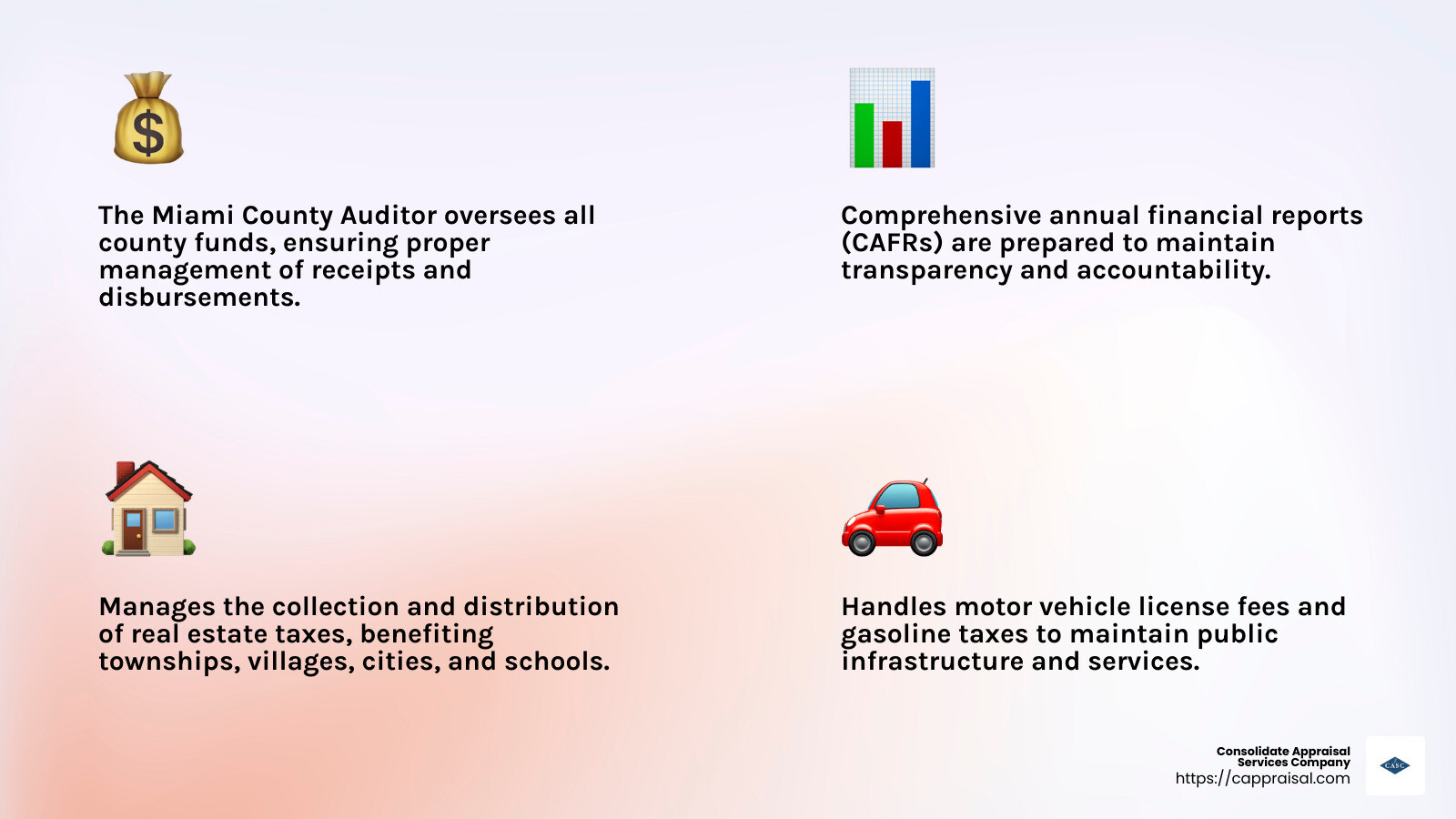

The Miami County Auditor is the watchdog over all county funds. This means they handle:

- Receipts and Disbursements: They account for all money received and spent by the county. This includes issuing warrants (checks) for all county obligations.

- Fund Balances: They maintain official records of all receipts, disbursements, and fund balances. This ensures that every dollar is tracked and managed properly.

- Financial Statements: The auditor’s office prepares comprehensive annual financial reports (CAFR), providing a detailed overview of the county’s financial status. These reports are crucial for transparency and accountability.

Tax Distribution

Tax distribution is another significant responsibility of the Miami County Auditor. They handle various types of taxes and fees, ensuring that funds are allocated correctly to different entities within the county:

- Real Estate Taxes: They manage the collection and distribution of property taxes, ensuring that funds are directed to townships, villages, cities, school districts, and library systems.

- Personal Property Taxes: These taxes are also collected and distributed by the auditor’s office.

- Motor Vehicle License Fees and Gasoline Taxes: The auditor distributes these funds, which are essential for maintaining infrastructure and public services.

- Estate Taxes and Local Government Funds: These are also managed by the auditor to support various county services and projects.

The Miami County Auditor ensures that all these funds are distributed accurately and fairly, supporting the county’s overall financial stability.

Payroll Management

The auditor’s office also serves as the paymaster for all county employees. This involves:

- Payroll Processing: Ensuring that all county employees are paid accurately and on time.

- Human Resources: Managing employee records and benefits, ensuring compliance with regulations.

In summary, the Miami County Auditor plays a critical role in managing the county’s finances, from overseeing tax distribution to ensuring accurate payroll for county employees. This comprehensive financial oversight is essential for the smooth operation of Miami County.

Next, we’ll explore the property appraisal process and the tools used by the auditor’s office to ensure accurate property valuations.

Property Appraisal Process

Understanding the property appraisal process is essential for anyone involved in real estate in Miami County. The Miami County Auditor oversees this process to ensure accurate property valuations, which are crucial for fair taxation and market stability.

Steps in Property Appraisal

- Property Inspection

- The first step in the appraisal process is a thorough inspection of the property. This involves examining the property’s physical condition, size, layout, and any unique features.

- Appraisers look at everything from the roof and foundation to plumbing and electrical systems to assess the property’s overall state.

- Data Collection

- During the inspection, appraisers collect data on various aspects of the property. This includes taking measurements, noting the number of rooms, and documenting any improvements or repairs.

- They also gather information on the property’s location, proximity to amenities, and neighborhood characteristics, which can significantly impact its value.

- Valuation Analysis

- After collecting all necessary data, appraisers analyze the information alongside comparable sales (comps) in the area. Comps are recent sales of similar properties, which help establish a benchmark for determining market value.

- The analysis also considers current market trends and economic conditions that could affect property values.

Tools and Resources

The Miami County Auditor provides several tools and resources to help property owners and buyers steer the appraisal process:

- Property Search

- The Property Search tool allows users to find detailed information about properties in Miami County. You can search by address, name, folio, or subdivision name.

- The tool provides key property characteristics, ownership details, sales information, and aerial imagery of the property.

- Comparable Sales Tool

- This tool helps users access and compare real estate sale information for properties in the county. By examining comparable sales, you can better understand the market value of a property.

- This comparison is crucial for both buyers and sellers to ensure they are making informed decisions.

- Tax Estimator

- The Tax Estimator provides an approximate amount of taxes due on a property. This is especially useful for potential buyers who want to understand the tax implications of their purchase.

- It uses current tax rates and property values to give a rough estimate of the annual property taxes.

- Tax Comparison

- The Tax Comparison tool allows users to view a property’s tax information for the current and previous year. It also highlights changes by taxing district, helping property owners understand how their taxes have changed over time.

- This tool is beneficial for budgeting and financial planning.

GIS Mapping System

The Miami County Auditor also employs a Geographic Information System (GIS) mapping system to improve the appraisal process. This system:

- Provides detailed maps showing property boundaries, land use, and zoning information.

- Allows users to apply various layers to the map, such as school districts, flood zones, and other relevant features.

- Helps in visualizing the spatial relationships between properties and their surroundings, which can affect property values.

In summary, the property appraisal process in Miami County involves a detailed inspection, thorough data collection, and careful valuation analysis. The Miami County Auditor provides several tools and resources, including property search, comparable sales, tax estimator, and tax comparison tools, to assist property owners and buyers in making informed decisions. The GIS mapping system further improves the accuracy and transparency of property appraisals.

Next, we’ll dive into the various services offered by the Miami County Auditor’s office, including property transfers, tax sales, and property tax deductions.

Miami County Auditor’s Office Services

The Miami County Auditor’s Office offers a wide range of services to assist property owners, buyers, and other stakeholders. These services include property transfers, tax sales, property tax deductions, and budget preparation. Let’s explore some of the key features and tools available.

Property Transfers

When a property changes hands, the Auditor’s Office ensures that the transfer is accurately recorded. This involves updating the ownership information in the county records. Accurate records are crucial for tax purposes and legal documentation.

Tax Sales

The Auditor’s Office handles tax sales, which occur when property taxes are delinquent. Properties with unpaid taxes may be sold to recover the owed amount. This process helps maintain the county’s financial health and ensures that all property owners contribute their fair share.

Property Tax Deductions

Property owners may qualify for various tax deductions, such as the Homestead Reduction for seniors and disabled individuals. To apply, contact the Miami County Auditor’s Office. These deductions can significantly reduce the amount of property tax owed.

Budget Preparation

The Auditor’s Office is also responsible for preparing the county budget. This involves forecasting revenue, allocating funds, and ensuring that all county departments operate within their financial means. The budget preparation process is transparent and involves input from various stakeholders.

Property Search Features

The Property Search tool is a valuable resource for anyone looking to find detailed information about properties in Miami County. Here’s what you can do with it:

- Search by Address or Name: Easily find properties by entering an address, owner’s name, folio number, or subdivision name.

- Ownership Information: Access current and past ownership details.

- Aerial Imagery: View current and prior year aerial images of properties.

- Map Features: Use interactive maps with zoom in/out capabilities and add layers like school districts and flood zones for more context.

Tax Calculation and Distribution

Understanding how property taxes are calculated and distributed is essential for property owners. Here’s a breakdown:

- Property Tax Calculation: Taxes are based on the property’s assessed value and the current tax rate. The Tax Estimator tool can help you get an approximate amount of taxes due.

- Settlement and Distributions: Collected taxes are distributed to various entities like townships, villages, cities, school districts, and library systems.

- Tax Sales: Properties with unpaid taxes may be subject to tax sales, where they are sold to recover the owed amounts.

The Miami County Auditor’s Office provides essential services that ensure transparency, accuracy, and efficiency in property-related matters. From property searches to tax calculations, these tools and resources are designed to help you make informed decisions.

Next, we’ll answer some frequently asked questions about the Miami County Auditor, including sales tax rates and the Auditor’s role in other states.

Frequently Asked Questions about the Miami County Auditor

How much is sales tax in Miami County, Ohio?

The sales tax rate in Miami County, Ohio is part of the overall Ohio sales tax. As of the latest update, the combined state and county sales tax rate is 7.25%. This includes a 5.75% state sales tax and an additional 1.5% county sales tax.

If you need more information on sales tax rates, you can visit the Ohio Department of Taxation website.

What does a county auditor do in Indiana?

A county auditor in Indiana has several key responsibilities, similar to those in Ohio but with some differences due to state laws. The auditor’s duties include:

- Auditing Claims: Reviewing and approving claims for payment from county funds.

- Financial Oversight: Managing the county’s finances, including receipts and disbursements.

- Statutory Authority: Ensuring compliance with Indiana state laws and regulations.

The auditor also handles property tax assessments and distributions, ensuring that funds are appropriately allocated to various county entities like schools and libraries.

What county is Troy, Ohio in?

Troy is located in Miami County, Ohio. It serves as the county seat and is home to various county offices, including the Miami County Auditor’s Office. The address for the Auditor’s Office is:

Miami County Safety Building

201 West Main Street

Troy, Ohio 45373

If you need to visit or contact the Auditor’s Office, their phone number is 937-440-5925.

For more information, you can visit the Miami County Auditor’s website.

Conclusion

Understanding the role of the Miami County Auditor is crucial for anyone dealing with property in Miami County, Ohio. The Auditor is responsible for a wide range of financial duties, from managing county funds to distributing tax revenue and ensuring accurate property valuations.

At Consolidated Appraisal Services Company, we specialize in providing accurate and reliable property appraisals. Whether you own agricultural land, commercial property, or a residential home, we offer expert answers to all your appraisal-related questions.

Our team is dedicated to delivering precise property valuations, ensuring you have the information you need for financial planning, tax purposes, and more. If you need help with property appraisal, don’t hesitate to reach out to us for expert guidance and support.

For more information or to schedule an appraisal, visit our website.

By understanding the Miami County Auditor’s roles and utilizing expert appraisal services like ours, you can steer your property-related needs with confidence.